What would you do with $2,300,000,000?

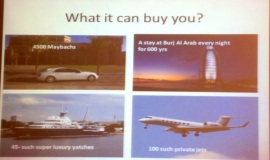

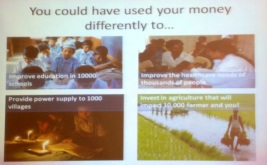

You could buy 4500 Maybachs, a stay at Burj Al Arab for 600 years, 45 luxury yachts or 100 private jets — OR — You could improve education in 10,000 schools, give healthcare to thousands, provide power to 1,000 villages, or invest in agriculture that will impact 10,000 farmers and you. Which would you choose?

This was the question Akash Nahar posed last Friday at the launch of a new chapter of Acumen Fund’s global community: Acumen+Bangalore.

For those of you who are not familiar, Acumen Fund is one of the most well-known leaders of patient capital / impact investing. They are structured as a non-profit, but operate as a fund, putting philanthropic capital to work as direct investments into for-profit social enterprises targeting the poor. Any profits they make are reinvested into new companies, so that the cycle can continue. In 12 years, they have looked at over 5,000 companies and made 73 investments in the sectors of healthcare, energy, water, sanitation, agriculture, housing, and recently for the first time in India, education. (If you want to learn more about Acumen Fund here is a great interview or you should really just read Jacqueline Novogratz’s book The Blue Sweater).

Acumen has launched volunteer-led chapters throughout the world to create an “interconnected community of global citizens” with the purpose of “learning and sharing Acumen Fund’s principles and approach to help create a world beyond poverty”. I attended an Acumen+NYC meeting earlier this year, so I was excited to learn that I had arrived in Bangalore just in time for the launch of this new chapter.

The meeting started with an introduction from Keya Madhvani from Acumen’s Mumbai office and Shahd AlShehail an Acumen Global Fellow working with Hippocampus Learning Centre, which is coincidently also a Unitus Seed Fund portfolio company that Acumen Fund invested Series A follow-on capital into.

Next up, members of The Yes We Can Foundation, the sponsoring organization and a Nahar Family Foundation, explained why they wanted to bring a new impact investing group to Bangalore. The Foundation is focused on the power of sports and play, and their name is inspired not by will.i.am or Barack Obama, but from a lesser known but equally American celebrity, Bob the Builder, whose relentless helping hand makes him a fitting role model for support and charity. It was interesting to hear how a family deeply rooted in the two separate worlds of finance and traditional philanthropy was willing embrace the hybrid approach to impact investing whereby investments are measured by both social and financial returns. Akash Nahar explained that to him it meant moving from Return on Investment (ROI) to Happiness on Investment (HOI).

But back to the original question: The number $2.3 Billion is on local minds here, because it is the amount that Azim Premji, Chairman of Wipro and local Bangalore Billionare, recently donated to charity. It was an interesting exercise to think about how to spend this imaginary money, especially here in India where the difference between wealth and poverty is so extreme, and some people might be more likely to, say, build a billion dollar home than support the slums beside it. To those in the room the question between buying yachts or finding innovative solutions to poverty was obvious, but it reminded me that the answer is still complex in an aspirational country where it can be just as important to prove that you have escaped poverty, as it is to stand by and support those who are still trapped in it.